A 401(k) is an account used to save (and grow!) your money for retirement(1). These accounts are offered by companies to their employees to help encourage them to invest their money and plan for retirement. You may ask, Why does offering a 401(k) encourage employees to save for retirement? –a fair question! Because 401k’s are what we call tax advantaged.

Rating: Finance Foundations

Most people have plans to retire someday, and in order to quit your job and kick back in the rocking chair, you need to have money saved. You’ll have bills just like you do now, but you won’t have a job any more, which means any money you spend will need to come from that retirement savings account. Because of this, we all have a lot of incentive to save for retirement!

Turns out the companies we work for and the U.S. government also want us to save money for retirement. The government encourages people to save their money for later in life by allowing you to contribute money for retirement to a tax-deferred account (for example, a 401(k)).

What is a tax-deferred account?!

Fear not – I’ll define:

The Official definition(2)

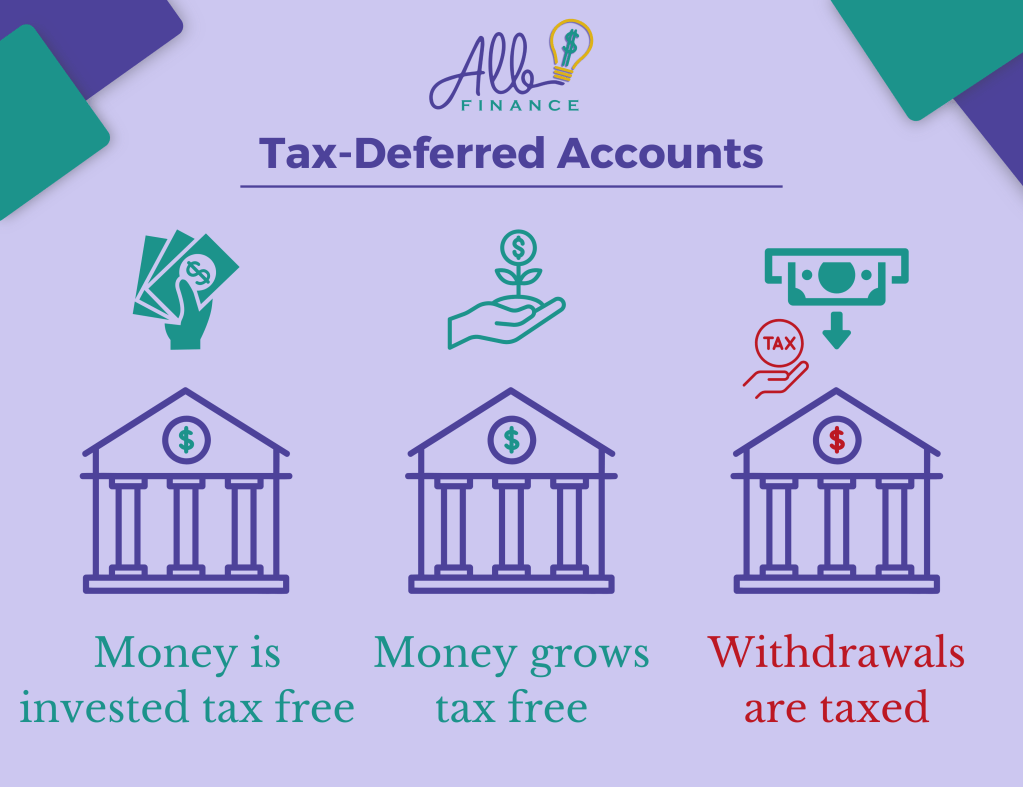

Contributions to tax-deferred accounts allow you to postpone paying taxes until you begin making withdrawals.

The ALB Finance broken down definition

When you make money, you have to pay income taxes. Income taxes come out of your paycheck. BUT! If you choose to put some of your paycheck in a tax-deferred account, you can avoid paying income tax right now.

You can then invest the money you put in the tax-deferred account. Any money earned from those investments will not be taxed now either.

When you decide to take money out of this tax-deferred account, then it will be taxed.

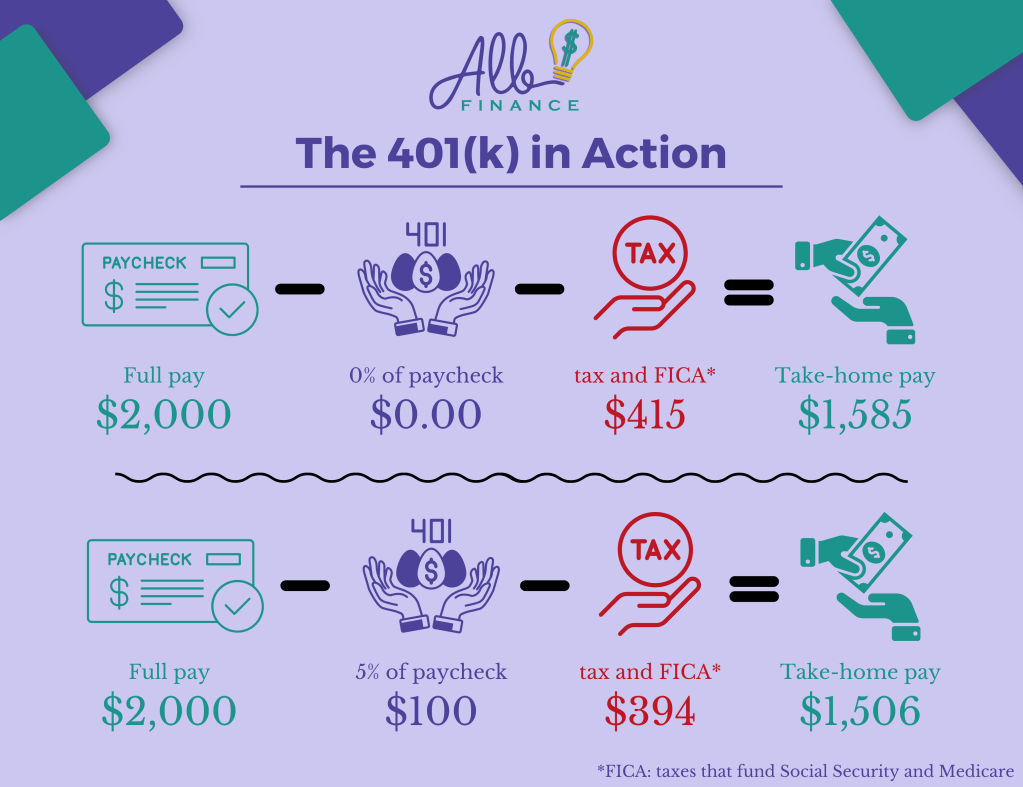

A 401(k) is a tax-deferred account! If your employer offers a 401(k), you can choose to put a percentage of each paycheck into your 401(k) account and you won’t be taxed on that amount. Hooray! It’s example time.

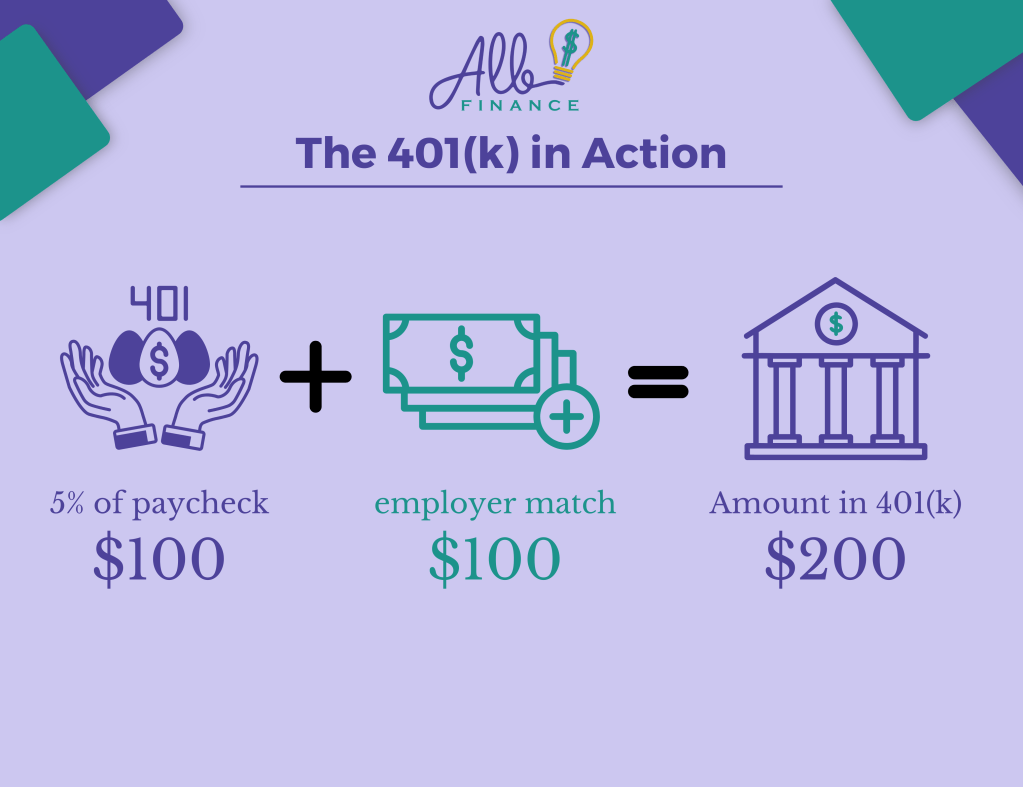

Leopold gets a $2,000 paycheck twice a month. He decides that he wants to begin saving for retirement, so he enrolls in his company’s 401(k) program. The company he works for has amazing benefits – they will match employee contributions up to 5% of their paycheck! Leopold wants to take full advantage of that, so he chooses to put 5% of each paycheck into his 401(k).

By doing this, he has reduced the amount of taxes he’s paying. He’s also investing in his future, which he’ll be very grateful for later down the road.

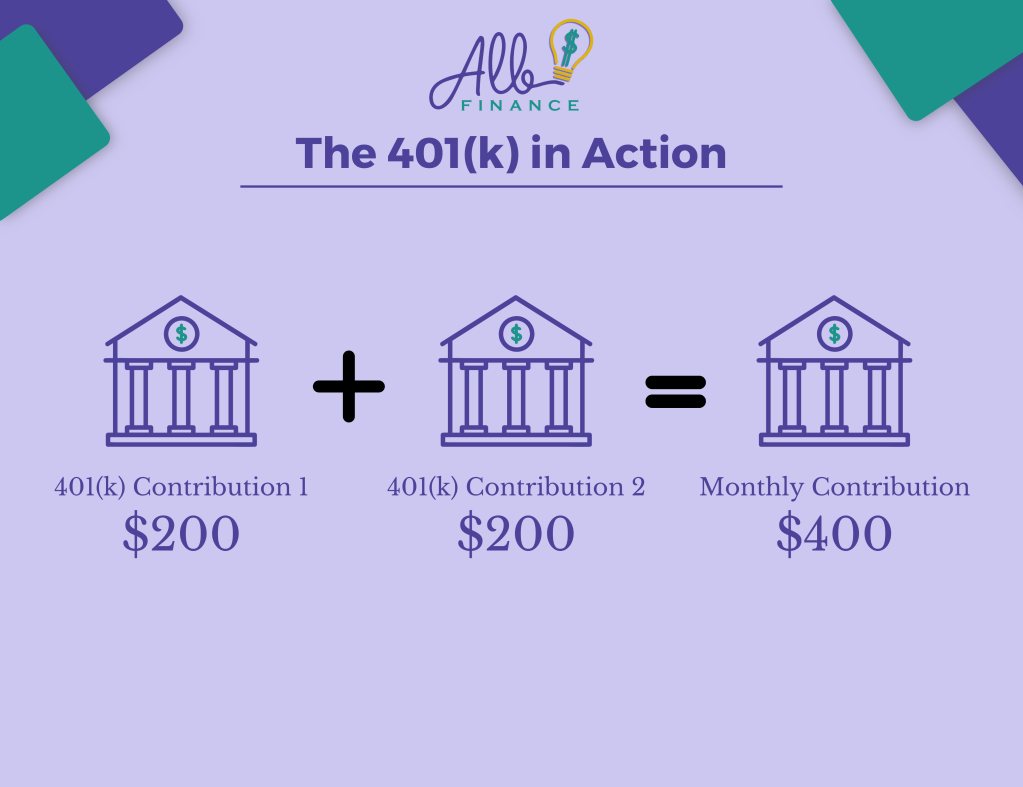

Now remember, Leopold’s employer will match his contributions up to 5% of his paycheck. That means that the company is also contributing $100 each pay period to Leopold’s 401(k)!

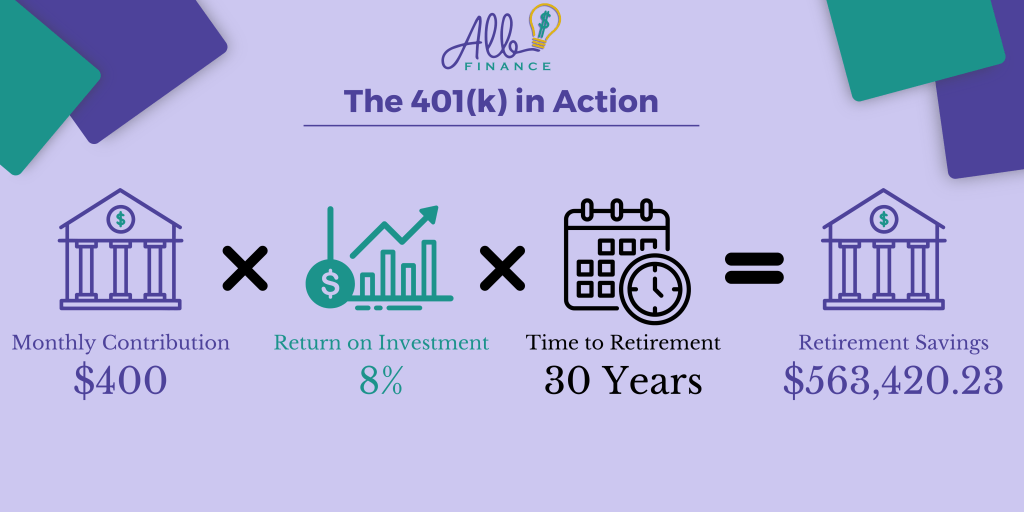

Every paycheck $200 is added to Leopold’s 401(k). That means Leopold’s monthly contribution is $400 – that’s fantastic.

Before we continue with our example, there is one incredibly important thing to know about a 401(k). The money in a 401(k) account shouldn’t just sit in a safe somewhere. That money needs to be invested, so it can earn money and grow over time. Many employers have general funds you can invest your money in. These funds are typically combinations of various investment products like stocks and bonds.

Over time, the $400 contributions Leopold makes will grow. For the sake of this example, we’ll use an average return on investment of 8%.

Leopold is 35, and he wants to retire at the age of 65. He’s curious how much he’ll have saved if he keeps investing $100 and getting a $100 employer match per paycheck. Let’s see!

…..what?

How did this happen?

This is the magic of using a 401(k) to save for retirement. There are two key things happening here:

- Leopold is consistent with his investments

- The money is growing over a long period of time

With consistency and time, your 401(k) can grow exponentially! Plus, this example assumes Leopold only invests $200 a month with a $200 employer match. Realistically, he’ll probably get raises each year, he’ll probably invest more per paycheck, and this number would actually be even larger.

Quickly! Let’s discuss some caveats to our material today!

- If you withdraw money from a 401(k) before you reach retirement age, you will be penalized. That penalty is ~10%.

- You must be 21 years old to enroll in a 401(k) plan.

- Many employers require employees work for a certain period of time before allowing them to enroll in a 401(k) plan.

So all in all, a 401(k) is an account designed to help you save for retirement. You can invest your money tax free and your money can grow tax free, which maximizes your returns. Many employers that offer a 401(k) plan also offer 401(k) matching. Consistently contributing to your 401(k), taking advantage of employer matching, and letting the money grow over time is an amazing way to secure your financial future.

Let’s summarize:

- A 401(k) is a tax-deferred account

- Tax-deferred accounts let you put money in without paying income tax. They also let your money grow without being taxed. You only pay tax on the money when you take it out of the account.

- 401(k) accounts are offered by employers to incentivize employees to save for retirement

- The government allows 401(k) accounts to be tax-deferred to incentivize citizens to save for retirement

- If your employer offers a 401(k) retirement plan, you should use it.

- If your employer offers a 401(k) match, you should definitely use it.

- It is essential to invest consistently and invest over time. That is how you maximize your 401(k) benefit.

References:

- Fernando, J. (September 5, 2024). 401(k): What It Is, How It Works, Pros, and Cons. Investopedia. https://www.investopedia.com/terms/1/401kplan.asp

- Moreano, G. (March 27, 2024). Tax-deferred: What does it mean and how does it benefit you?. Bankrate. https://www.bankrate.com/retirement/tax-deferred-what-does-it-mean/

- Sham, J. (July 24, 2024). 401(k) Guide: Definition and How The Plans Work. NerdWallet. https://www.nerdwallet.com/article/investing/what-is-a-401k#how-does-a-401(k)-work

- Fidelity. (June 26, 2024). Thinking of taking money out of a 401(k)?. https://www.fidelity.com/viewpoints/financial-basics/taking-money-from-401k#:~:text=These%20hypothetical%20examples%20compare%20taking,out%20from%20the%20loan%20scenario.

- Martins, A. (August 31, 2024). 401(k) Age Limits: Can You Be Too Young for One?. Investopedia. https://www.investopedia.com/401k-age-limits-too-young-5323754

- Droblyen, E. (August 7, 2023). 401(k) Eligibility: When to Let Employees Join Your Plan. Employee Fiduciary. https://www.employeefiduciary.com/blog/401k-eligibility-when-to-let-employees-join-your-401k-plan

Leave a comment