First things first: A high yield savings account (HYSA) is a ways to make a ton of money by doing nothing but moving your money to a new account. HYSAs pay a TON more in interest than your standard savings account, and the more money you keep in there, the more interest you’ll earn.

If you need to brush up on what interest is, you can get a general overview here.

Rating: Finance Foundations

Saving money can be really fun. Watching that little number get bigger and bigger over time is so rewarding, especially if someone else is adding money too! Every savings account gives you a little bit of bonus money (interest) as a thank you for trusting them with your money.

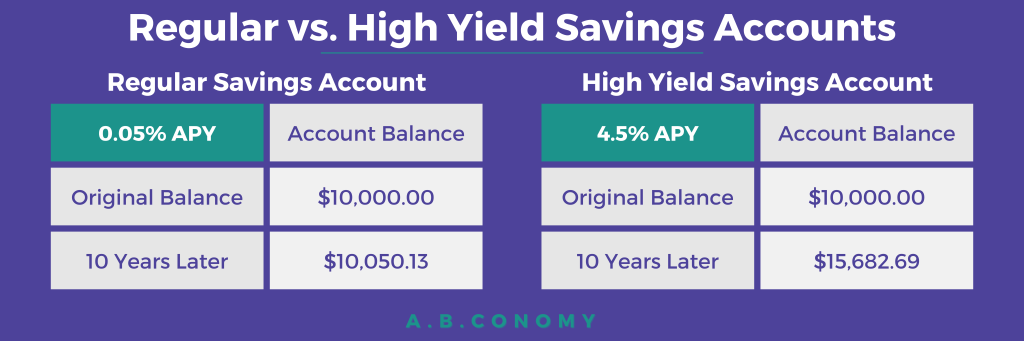

Regular savings accounts will give you an APY (annual percentage yield) of about 0.05%. That means they are giving you less than a tenth of a percent each year. That’s not very helpful…

A High Yield Savings Account (HYSA), on the other hand, will give you an APY of 4-5%! That means you’re going to be making considerably more money if you put your savings into a HYSA. Let’s look at just how much of a difference that difference in bonus money (APY) makes.

Let me walk you through what you’re looking at here. The regular savings account only gave you about $50 over the course of TEN WHOLE YEARS. That’s honestly terrible.

In 10 years your $10,050 is going to be worth a wholeeee lot less than it is today. Have you ever noticed how prices get more expensive over time? That’s called inflation, and it means that over time you’ll be able to buy less stuff with the same amount of money. Boo 😦

BUT! Look to the right! The High Yield Savings Account leaves you with a beautiful $15,682.69 after 10 years. This means that you made $5,632.56 more with the HYSA than you would have with a regular account.

That difference is massive, and it means that in 10 years, you’ll be able to buy the same amount of stuff despite inflation. Prices may grow, but your savings will too!

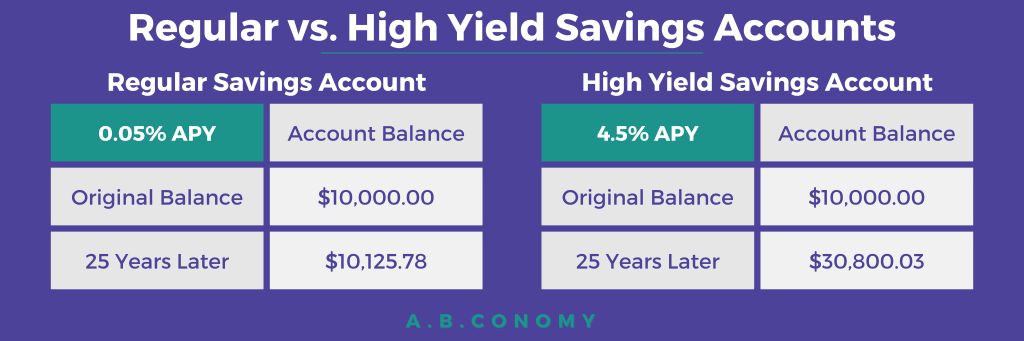

Just for funsies, let’s look at what happens if we let that $10,000 sit in the HYSA for 25 years instead of 10 years. Spoiler alert – your account balance almost triples over 25 years!

The regular savings account makes you a whopping $125.78. After 25 years, your $10,125 doesn’t buy you anywhere close to what it would have before. You’ve saved this money, but you’ve lost purchasing power. That means even though you were amazing and left your money alone, at the end of the 25 years, you can buy less than you could have at the beginning. Yikes.

Meanwhile, our trusty HYSA is doing its thing and making us tons of money ♥ The difference between these accounts is now $20,674.25. Making more than 20k for doing nothing is crazy.

I think you get the point here – $10,000 in today’s money is not the same as $10,000 in the year 2050! It’s so important to maintain your purchasing power over time, and with a HYSA, you can maintain and grow your wealth over time.

Both of the examples we’ve discussed today are simplified. They both start with you putting $10,000 in the account and then never saving another penny. In reality, you’d hopefully add more money to the savings account over time. Adding additional savings each month only further expands the difference between the regular account and HYSA. Switching over is a great way to guarantee growth in your savings account.

Opening a HYSA is easy! It usually takes about 15-20 minutes, and trust me, it is well worth your time. I’m not going to give out any specific recommendations, but Nerd Wallet puts together a list ranking them every single month. Click here for the June edition.

To wrap this up, I’ll leave you with three key points:

- High Yield Savings Accounts give you bonus money for keeping your savings in there. The higher the APY (annual percentage yield), the more bonus money they’re giving you.

- If you keep your money in a regular savings account, you will earn a teeny bit of bonus money (APY), but you’ll lose purchasing power over time due to inflation. This means that even though you’ll have a little more money in the end, you’ll be able to buy less stuff.

- Opening a HYSA is easy, and in the long run, the difference is astronomical.

Check out my math here:

References:

Knueven, L. & Acevedo, S. (Dec 5,2023). How are high-yield savings accounts different from savings accounts? One earns you about 12 times more on your money. Business Insider. https://www.businessinsider.com/personal-finance/high-yield-savings-accounts-vs-regular-savings

Porter, K. (May 7, 2024). High-yield savings accounts help your money grow at a faster rate. Fortune Recommends. https://fortune.com/recommends/banking/what-is-high-yield-savings-account/

Leave a comment