First things first: A recession is a period of significant economic decline. Typically, markers of ‘significant economic decline’ are 2+ quarters of negative GDP growth, unemployment spikes, inverted yield curves, and uncontrolled inflation.

Intermediate Econ

I always want to present clear, easy to understand content for everyone. Because this is a ‘Finance Friendly’ rated topic, it has some complex concepts that may not be suitable for all readers. If you have a strong background in finance and economics, feel free to continue reading!

However, if you are new to finance and economics, it may be helpful to study up on some key information before beginning this article. I am confident that you will be able to grasp these concepts once you fill in some context, so here are some helpful prerequisite articles for you to read:

Once you’ve read these articles come on back and let’s talk about recessions!

Over the past several years I’m sure you’ve heard plenty of talk about recessions, economic turmoil, and ‘unprecedented times’, but what do these things actually mean?

There are several different ways to define a Recession, so I’ll go over the most commonly used definitions and indicators.

2+ Quarters of Negative GDP Growth

GDP growth is a key benchmark of a country’s economic health. As long as GDP is growing steadily, the country is, for the most part, in a period of economic stability. Unfortunately, sometimes countries have quarters of negative GDP growth.

This isn’t terribly concerning if it’s just one quarter at a time. However, if a country’s GDP growth is negative for two or more quarters, it is usually an indicator of a recession. This is both the most common, the most measurable, and the most widely accepted definition for a recession. The other three indicators we’ll talk about today are a bit more subjective.

Unemployment Spikes

People need jobs to make money, and people need money to buy things! If people don’t have jobs, they can’t spend money, and given that Consumer Spending makes up about two thirds of GDP, that can become a major issue very quickly.

There are several reasons Unemployment can increase. Let’s talk about a couple of the main drivers!

First, high unemployment can be caused by decreased demand for goods and services. If less consumers want to purchase products, companies may start to panic. Decreased consumer spending can lead to decreased profits or even losses. This brings me to our second driver.

Second, if companies see below-average profits, they will likely start laying off employees in an attempt to keep their shareholders happy. Increased layoffs lead to – you guessed it – increased unemployment!

If there’s less demand for products, companies will start laying off employees. If companies start laying off their employees, unemployment will increase. If a company is laying people off, it’s probably not interested in hiring new people. If there are more people looking for jobs and less people hiring, more people become and remain unemployed.

And of course, as we discussed before, unemployment leads to lower consumer spending, which only exacerbates the issue. What a vicious cycle! It’s no surprise unemployment spikes are a key indicator of recession.

Inverted Yield Curves

This concept is a bit of a tricky one, so let’s begin with Investopedia’s beautiful definition:

“An inverted yield curve occurs when short-term debt instruments have higher yields than long-term instruments of the same credit risk profile.”

How lovely! Let me break this down for you.

For this section, we will use Treasury Bonds for our examples. A Treasury Bond, or ‘Treasury’, is a bond issued by the government. Anyone can purchase these Treasuries from the government, and after a period of time, the Treasury will come to ‘maturity’.

When the bond matures, the government will give you back your money, plus a little bit extra! The interest made on this Treasury is called the yield. Treasuries can be issued for very short-term periods, like 3 months, or extremely long periods of time, such as 30 years! When purchasing Treasury bonds, it’s very important to hold the bond until maturity. If you pull your money out early, at best, you won’t make as much interest as you hoped. At worst, you may actually lose money.

It’s important to note that U.S. Treasury Bonds have almost no risk. Because they are (nearly) riskless, they are a good indication of how the public feels about the economy.

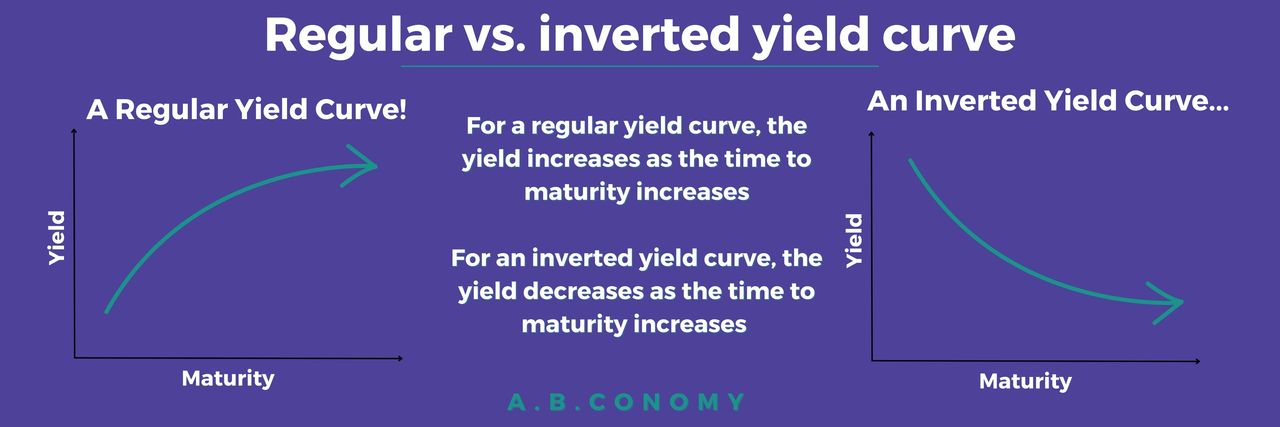

Bonds held for a longer period of time usually have a higher yield. However, if people are feeling uncertain about the economy and are unsure what the future holds, this concept flips. This is called an inverted yield curve.

When the yield curve is inverted, short-term bonds pay higher yields than long-term bonds. This indicates that people are unsure of the future and would prefer to buy only short-term debt instruments. When this shift happens, the yield curve changes from its usual positive slope to a negative one. This, my friends, is a key indicator of a recession.

Time to use my Canva skills (or lack thereof) and make a graphic for my visual learners!

As seen in the graphic above, an inverted yield curve shows that investors are not interested in tying up their money long term. After all, if you’re not sure what the economy will look like in the future, would you want your money in a bond that won’t mature for 10 years?

The easiest way to analyze the yield curve is to look at the U.S. 10 Year Treasury and compare it to the 2 Year Treasury. This can give key insight into how the public feels about the future of the economy. In fact, since 1955 the inverted yield curve has accurately predicted a recession with only one false positive (McWhinney 2023).

Uncontrolled Inflation

The last recession indicator I’ll talk about today is uncontrolled inflation. Inflation itself isn’t a bad thing – it’s actually very normal. The average (mean) inflation rate was 2.44% between 2012 and 2022, and 2.49% between 2000 and 2022. This means that if something cost $1.00 it would, on average, cost $1.02 the next year. That’s not so bad!

One important thing to recognize is that inflation is not the issue – uncontrolled inflation is. The average inflation rate has been around 2.5% for a long while. This is why inflation of 4.7% in 2021 shocked the public. In 2022, inflation climbed to 8%, reaching the highest inflation we’d seen since the 1980s.

Staples such as gasoline and eggs became almost unaffordable for the average household in America. Inflation had reached the point at which it was officially out of control. When the average person can’t afford to pay for their basic everyday needs, it’s a good indicator that you may be headed for a recession.

Conclusion

So there you have it friends! Four common indicators of recession are 2+ quarters of negative GDP growth, Unemployment Spikes, An Inverted Yield Curve, and Uncontrolled Inflation. Typically, a recession will lead to all four of these indicators occurring, but keep in mind that the quickest, most measurable, and most widely accepted definition of a recession is 2+ quarters of negative GDP growth.

Here’s a summary of what we learned today:

- A recession is most commonly defined as 2+ Quarters of negative GDP growth

- Increased unemployment is often times an indicator you are either in a recession or nearing one.

- Higher unemployment leads to decreased consumer spending, and decreased consumer spending leads to less profit for companies. Less profit for companies leads to increased layoffs, and increased layoffs leads to higher unemployment. Once this cycle begins, it is extremely difficult to stop.

- An inverted yield curve is a strong marker of a recessionary environment because it represents how investors feel about the future of the economy. Inverted yield curves have accurately predicted recessions since 1955 with only one false positive.

- A regular yield curve’s yield will increase as the time to maturity increases. This shows that investors feel confident in the future in the economy and are willing to have their money tied up in bonds for 10+ years!

- An inverted yield curve’s yield will decrease as the time to maturity increases. During times where the yield curve is inverted, investors are more willing to purchase short-term Treasury Bonds to ensure that they will get their money (and interest!) back quickly.

- Inflation is normal and is not in and of itself a concern. However, periods of uncontrolled inflation can indicate the potential of a recession.

- Inflation typically remains between 2% and 3%, so when inflation reaches sky-high numbers like 6%, 7%, or 8%, it can become difficult to maintain purchasing power. Average households may struggle to meet their family’s basic needs, but unfortunately, it is incredibly difficult to mitigate inflation.

Luckily, GDP, Unemployment, and Inflation are not currently showing signs of a recession. On the other hand, the yield curve is most certainly inverted right now, which is highly accurate predictor of a recession. If you’re interested in learning more, see here for an overview and analysis by US Bank (December 2023).

I hope you enjoyed this article and better understand what a recession is and how to tell if one may be coming! If you have any questions about the material in today’s article, feel free to reach out with questions. I am always available and happy to answer any questions about finance or the economy.

References:

– Liberto, D. (December 4, 2023). Inverted Yield Curve: Definition, What It Can Tell Investors, and Examples. Investopedia.

(December 19, 2023). Treasury yields invert as investors weigh risk of recession. US Bank.

McWhinney, J. (August 20, 2023). The Impact of an Inverted Yield Curve. Investopedia.

https://www.investopedia.com/articles/basics/06/invertedyieldcurve.asp

Leave a comment